Doo Group Reports Record Trading Volume in April 2025

Doo Group, a pre-eminent financial services group with FinTech as its core, recently released its April 2025 trading volume report.

April Trading Volume Overview 2025

- Total Trading Volume: USD 193.05 billion

- Most Popular Products: XAU/USD, EUR/USD, US30 (Dow Jones), NAS100 (Nasdaq), GBP/USD

- XAU/USD saw the highest trading volume.

- GC_2506 saw the highest increase, a surge of 104.28%.

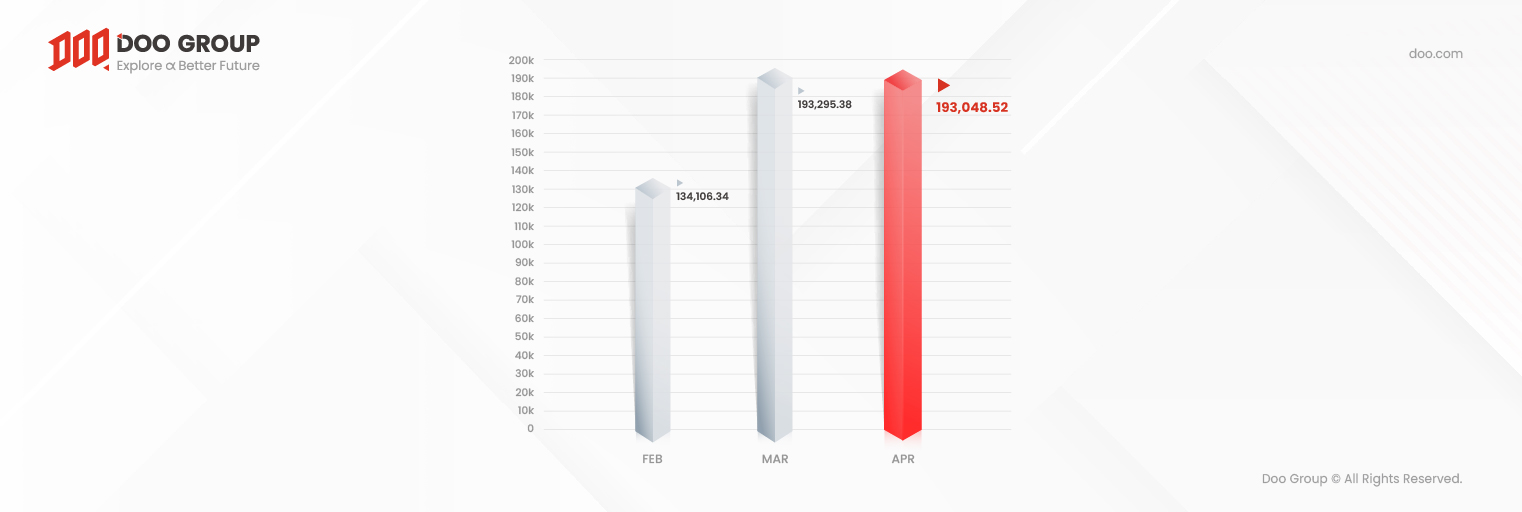

According to the report, Doo Group’s total trading volume in April is valued at USD193.05 billion, a close tie with the group’s historical high last month. Furthermore, April’s average daily volume (ADV) is USD 6.44 billion, a slight increase of 3.23% from March.

The global macro-environment was hit with strong volatility in April. On 2 April, the US president, Donald Trump, announced a series of “reciprocal tariffs” beyond the market expectations. This has opened the doors for global trade wars, causing the Cboe Volatility Index (VIX Index) to significantly rise due to the bumpy financial markets.

At the beginning of April, all 3 US indexes drastically declined to touch the early 2024 levels. Immense growth in risk aversion has caused gold to surge, XAU/USD briefly reached the significant psychological level of USD 3,500 per ounce during April, before drifting back lower but remained confidently above the USD 3,000 level. “Long gold” has also become one of the most traded products.

Besides, the continuous pressure on the global economy due to Trump’s tariff measures brings risks to the USD’s credit rating. With that, the US Index level plunged, and EUR, GBP, and other non-USD currency–related products have portrayed strong performances in April.

Doo Group continues to provide global users with a highly efficient and more reliable investment experience in this volatile and opportunistic market. April’s total trading volume has increased 75.99% as compared to the same period last year, showcasing its strong growth momentum and market attractiveness.

As for the investors’ top picks, XAU/USD, EUR/USD, US30 (Dow Jones), NAS100 (Nasdaq), and GBP/USD are among the top 5 most popular products. Leveraging the gold trade wave in April, XAU/USD took the crown in April with a transaction value of USD 174.65 billion.

Apart from that, Gold Futures, GC_2506, showed a stunning performance, with a huge surge of 104.25% as compared to last month, becoming the product with the largest growth in April.

As an internationally leading financial services group, Doo Group continues to show strong momentum in its trading volume. In the future, Doo Group will continue to develop a global FinTech system and build a comprehensive financial ecosystem, to lead the FinTech transformation in this era, ensuring that our clients are at the forefront of the industry.

Disclaimer:

Doo Group is a brand name and does not represent a legal entity or a regulated financial institution. The financial services, trading activities, and operations referenced in this report are conducted by legally registered and licensed entities affiliated with Doo Group. Each entity operates independently in compliance with the applicable laws and regulations of its respective jurisdiction.

This report is for informational purposes only and should not be considered as financial or investment advice. The data presented is based on internal records and may be subject to change or revision. Past performance is not indicative of future results. The market commentary provided within this report is for general reference only and does not constitute a recommendation to trade or invest.

Doo Group and its affiliated entities disclaim any liability for inaccuracies, errors, or omissions in the information contained herein. Readers should conduct their own research and consult with a qualified financial professional before making any trading or investment decisions.

For further details on the legal entities under Doo Group and their regulatory status, please refer to our official website or contact us directly.

-

Doo Group Showcases at the Singapore FinTech Festival 2025: Creating a New Blueprint for Finance.Event | 19 Nov 2025 05:45/PM GTMFrom 12 - 14 November 2025, the global FinTech industry gathered at the Singapore Expo to mark the country’s 60th Independence Anniversary and the 10th Anniversary of…

Doo Group Showcases at the Singapore FinTech Festival 2025: Creating a New Blueprint for Finance.Event | 19 Nov 2025 05:45/PM GTMFrom 12 - 14 November 2025, the global FinTech industry gathered at the Singapore Expo to mark the country’s 60th Independence Anniversary and the 10th Anniversary of… -

Moving Forward Without Limits: Celebrating Doo Group’s 11th AnniversaryNews | 18 Nov 2025 10:45/AM GTMDoo Group celebrates its 11th anniversary on 18th November 2025. Eleven years mark not just a milestone, but a journey of growth and reflection. Since our foundi…

Moving Forward Without Limits: Celebrating Doo Group’s 11th AnniversaryNews | 18 Nov 2025 10:45/AM GTMDoo Group celebrates its 11th anniversary on 18th November 2025. Eleven years mark not just a milestone, but a journey of growth and reflection. Since our foundi… -

Doo Group Reports Record Trading Volume in October 2025News | 17 Nov 2025 11:31/AM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its October 2025 trading volume. October Trading Volume Overview 2…

Doo Group Reports Record Trading Volume in October 2025News | 17 Nov 2025 11:31/AM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its October 2025 trading volume. October Trading Volume Overview 2… -

Doo Group Reports Record Trading Volume in September 2025News | 21 Oct 2025 03:03/PM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its September 2025 trading volume. September Trading Volume Overview 2025…

Doo Group Reports Record Trading Volume in September 2025News | 21 Oct 2025 03:03/PM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its September 2025 trading volume. September Trading Volume Overview 2025… -

A Decade of Opportunities: Join Doo Group at Singapore FinTech Festival 2025Blog | 15 Oct 2025 03:00/PM GTMThe world’s premier FinTech event — the Singapore FinTech Festival (SFF) — will take place from November 12 to 14, 2025, at the Singapore Expo. Marking Singap…

A Decade of Opportunities: Join Doo Group at Singapore FinTech Festival 2025Blog | 15 Oct 2025 03:00/PM GTMThe world’s premier FinTech event — the Singapore FinTech Festival (SFF) — will take place from November 12 to 14, 2025, at the Singapore Expo. Marking Singap…

Newsletter

Instantly grasp the latest insightful trading views