Doo Group Reports Record Trading Volume in December 2021

December 2021 Trading Volume Overview

- Total Trading Volume: USD53.99 billion

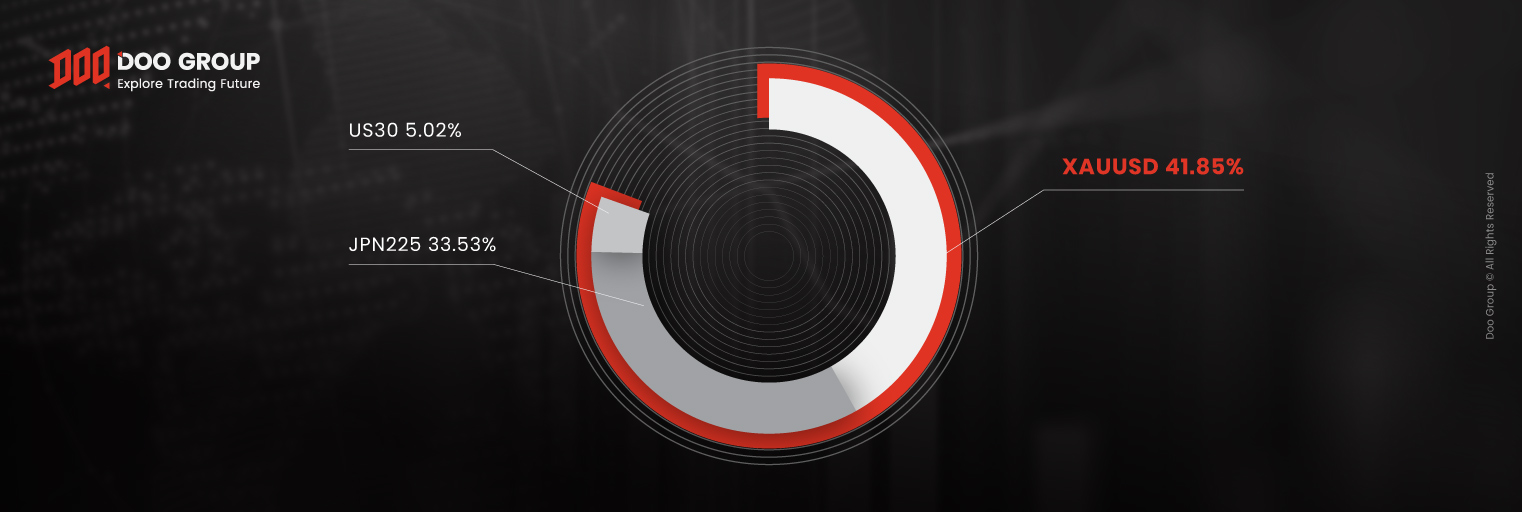

- Most popular trading products of traders: XAU/USD, JPN225, US30

- XAU/USD recorded the highest trading volume at USD22.59 billion

- JPN225 posted the highest increase in trading volume of 4189.37%

(+USD17.68 billion)

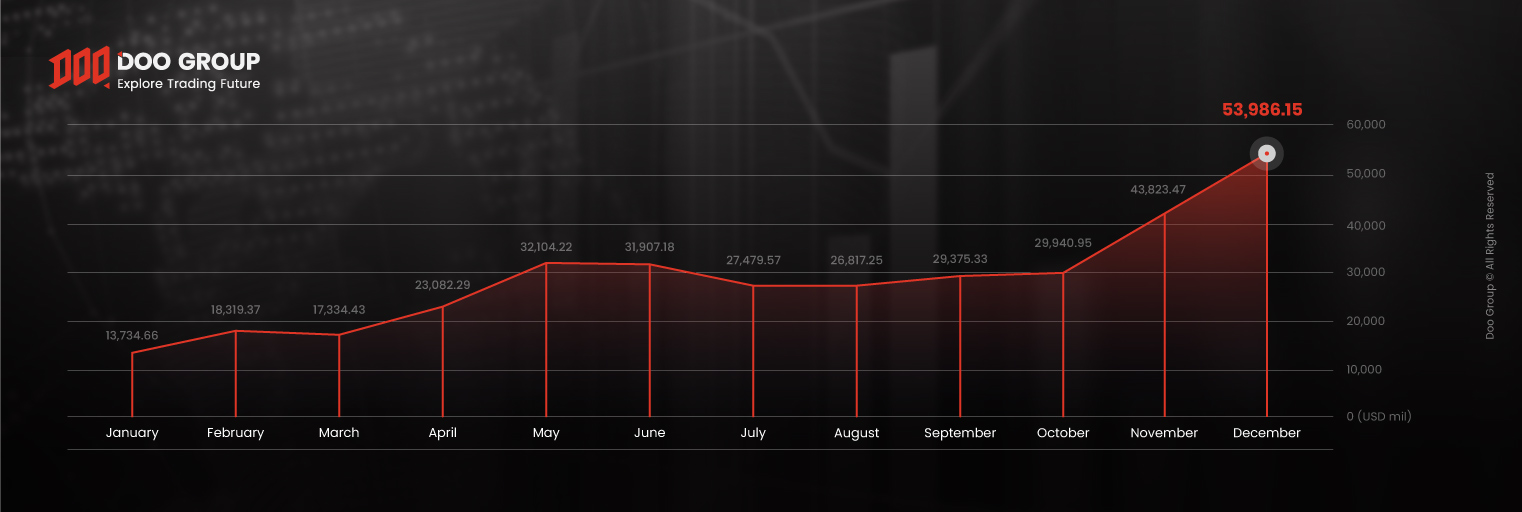

Doo Group, a financial services group with cutting edge-technology and solutions, recorded USD53.99 billion of total trading volume in December 2021.

The total trading volume increased by 23.19% compared to the month before. In addition, there is a significant year-to-year increase: the trading volume soared by a massive 223.6% compared to December 2020’s USD16.69 billion.

Meanwhile, the average daily volume (ADV) in December 2021 was recorded at USD1.74 billion, which is an increase of 19.22% compared to the previous month.

With those figures, Doo Group’s total volume traded for the year-to-date has accumulated to USD347.93 billion.

Overall, Doo Group’s trading volume for the full year of 2021 was positive, with a strong overall growth trend despite small declines recorded in March, June, July and August. The highest monthly transaction volume was in December, accounting for 15.52% of the total volume in 2021.

This number is a total of trading volumes from the Group’s affiliates, Doo Clearing, which is a London-based FCA-regulated liquidity provider, and Doo Prime, a leading global online broker.

According to the data, XAU/USD, JPN225 and US30 are the leading choices for traders. They took up 80.4% of total trading volume in December 2021.

XAU/USD recorded the highest monthly trading volume of USD22.59 billion, while JPN225 and US30 recorded USD20.81 billion of the overall monthly trading volume.

Based on previous Trading Volume reports, this is the first time in 2021 that JPN225 and US30 ranked within the top three trading products. In addition, JPN225’s monthly trading volume grew the most, up USD17.68 billion or 4789.37% from November 2021.

While there are many factors contributing to this growth and jump, there is no question that Doo Group has the capability to boost its performances in months and years to come.

The company will continue to create a global fintech system and lead the way to a new era of fintech-driven globalization.

As a financial services group, Doo is committed to establishing a financial ecosystem network that empowers clients to stay one step ahead.

About Doo Group

Doo Group established in 2014, currently headquartered in Singapore. After years of development, Doo Group has become a financial services group with financial technology as its core.

With multiple sub-brands such as Doo Clearing, Doo Financial, Doo Prime, FinPoints and more, Doo Group is committed to provide trading brokerage and asset management services for over 20,000 financial products such as Securities, Futures, Forex, CFDs and Funds to global individual and institutional clients.

Currently, Doo Group is strictly regulated by many top global financial regulators, including the United States Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA), United Kingdom Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), the Seychelles Financial Services Authority (FSA), Mauritius Financial Services Commission (FSC), and the Vanuatu Financial Services Commission (SFC), with operating centres in Dallas, London, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur and other regions.

Visit us at www.doogroup.com

For enquiries and further information, please contact us:

Hong Kong: +852 6701 2091

Email: [email protected]

DISCLAIMER

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Past performance of an investment is not an indication of its performance in the future. Doo Group makes no representation and warranties to the information displayed and shall not be liable for any direct or indirect loss or damages as a result of any inaccuracies and incompleteness of the information provided. Doo Group shall not be liable for any loss or damages as a result of any direct or indirect trading risks, profit, or loss associated with any individual’s investment.

-

Doo Group Reports Record Trading Volume in June 2025News | 16 Jul 2025 10:06/AM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its June 2025 trading volume report. June Trading Volume Overview 2025…

Doo Group Reports Record Trading Volume in June 2025News | 16 Jul 2025 10:06/AM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its June 2025 trading volume report. June Trading Volume Overview 2025… -

Doo Group’s Technology Arm Signs MoU with Alibaba Cloud to Co-Build a New FinTech EcosystemNews | 15 Jul 2025 11:16/AM GTMOn 2 July 2025, Doo Tech, a company under the Doo Group umbrella signed a Memorandum of Understanding at the Alibaba Cloud Global Summit 2025 held in Singapore. …

Doo Group’s Technology Arm Signs MoU with Alibaba Cloud to Co-Build a New FinTech EcosystemNews | 15 Jul 2025 11:16/AM GTMOn 2 July 2025, Doo Tech, a company under the Doo Group umbrella signed a Memorandum of Understanding at the Alibaba Cloud Global Summit 2025 held in Singapore. … -

Doo Group 2025 Mid-Year ReportNews | 30 Jun 2025 11:41/AM GTM

Doo Group 2025 Mid-Year ReportNews | 30 Jun 2025 11:41/AM GTM -

Doo Group Reports Record Trading Volume in May 2025News | 16 Jun 2025 10:25/AM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its May 2025 trading volume report. May Trading Volume Overview 2025 …

Doo Group Reports Record Trading Volume in May 2025News | 16 Jun 2025 10:25/AM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its May 2025 trading volume report. May Trading Volume Overview 2025 … -

Doo Group Reports Record Trading Volume in April 2025News | 30 May 2025 09:28/AM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its April 2025 trading volume report. April Trading Volume Overvie…

Doo Group Reports Record Trading Volume in April 2025News | 30 May 2025 09:28/AM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its April 2025 trading volume report. April Trading Volume Overvie…

Newsletter

Instantly grasp the latest insightful trading views