Doo Group Reports Record Trading Volume in March 2024

Doo Group, a pre-eminent financial services group with FinTech as its core, recently released its March 2024 trading volume report.

March Trading Volume Overview 2024

- Total Trading Volume: USD 95.56 billion

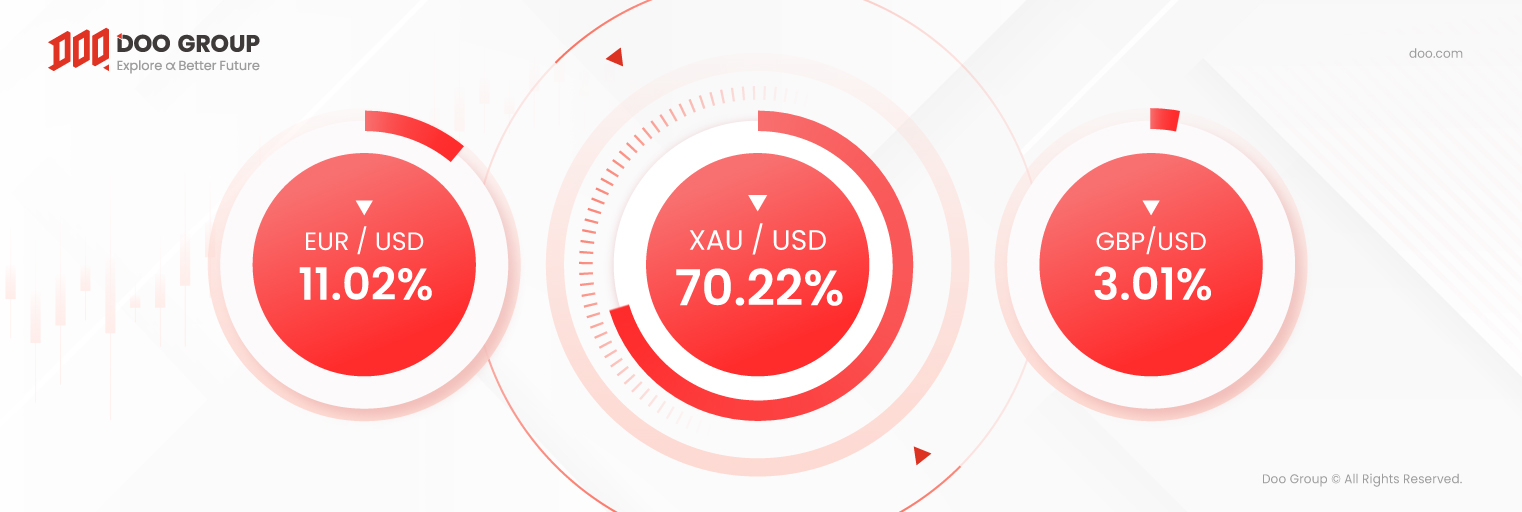

- Most Popular Products: XAU/USD, EUR/USD, GBP/USD

- XAU/USD saw the highest trading volume at USD 67.11 billion.

- XAU/USD saw the highest increase, an increase of USD 22.60 billion or 50.70%.

(The reported data includes the total trading volume of Doo Group’s sub-brands – Doo Clearing and Doo Prime)

According to the report, Doo Group’s total trading volume in March 2024 is valued at USD 95.56 billion, an increase of 35.04% from the previous month. Furthermore, March’s average daily volume (ADV) is USD 3.08 billion, an expansion of 26.33% from February.

The global gold market has been active recently, with gold prices reaching record highs, attracting many investors to invest in gold. This gold price spike was supported by various reasons, including geopolitical tensions and the announcement of US monetary policy. Furthermore, the increase in gold reserves by the central banks and market concerns about inflation have caused investors to enter the gold market due to risk aversion.

This has also led XAU/USD to be not only the product with the highest volume in March, but also the product with the greatest increase in trading volume.

Since the beginning of 2024, Doo Group’s trading volume has been in a stable state. Year to date, Doo Group’s total trading volume is valued at USD 248.78 billion, an expansion of 13.80% as compared to the same period last year.

According to the recorded data, XAU/USD, EUR/USD, and GBP/USD were the investors’ top picks, contributing 84.25% of March’s total trading volume. Among them, XAU/USD has the highest monthly trading volume at USD 67.11 billion; while EUR/USD and GBP/USD have a total monthly trading volume of USD 13.41 billion.

Besides, XAU/USD has the largest growth in the monthly trading volume, an increase of USD 22.60 billion or 50.70% as compared to February.

As an internationally leading financial services group, Doo Group continues to show a strong momentum in its trading volume. In the future, Doo Group will continue to develop a global FinTech system and build a comprehensive financial ecosystem, striving to lead the FinTech transformation in this era, ensuring that its clients are at the forefront of the industry.

-

Doo Group Reports Record Trading Volume in September 2025News | 21 Oct 2025 03:03/PM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its September 2025 trading volume. September Trading Volume Overview 2025…

Doo Group Reports Record Trading Volume in September 2025News | 21 Oct 2025 03:03/PM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its September 2025 trading volume. September Trading Volume Overview 2025… -

A Decade of Opportunities: Join Doo Group at Singapore FinTech Festival 2025Blog | 15 Oct 2025 03:00/PM GTMThe world’s premier FinTech event — the Singapore FinTech Festival (SFF) — will take place from November 12 to 14, 2025, at the Singapore Expo. Marking Singap…

A Decade of Opportunities: Join Doo Group at Singapore FinTech Festival 2025Blog | 15 Oct 2025 03:00/PM GTMThe world’s premier FinTech event — the Singapore FinTech Festival (SFF) — will take place from November 12 to 14, 2025, at the Singapore Expo. Marking Singap… -

Doo Group August 2025 Trading Volume ReportNews | 29 Sep 2025 03:44/PM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its August 2025 trading volume. August Trading Volume Overview 2025 …

Doo Group August 2025 Trading Volume ReportNews | 29 Sep 2025 03:44/PM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its August 2025 trading volume. August Trading Volume Overview 2025 … -

Doo Group Reports Record Trading Volume in July 2025News | 14 Aug 2025 12:00/PM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its July 2025 trading volume. July Trading Volume Overview 2025 …

Doo Group Reports Record Trading Volume in July 2025News | 14 Aug 2025 12:00/PM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its July 2025 trading volume. July Trading Volume Overview 2025 … -

Doo Group Reports Record Trading Volume in June 2025News | 16 Jul 2025 10:06/AM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its June 2025 trading volume report. June Trading Volume Overview 2025…

Doo Group Reports Record Trading Volume in June 2025News | 16 Jul 2025 10:06/AM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its June 2025 trading volume report. June Trading Volume Overview 2025…

Newsletter

Instantly grasp the latest insightful trading views