Doo Group Reports Record Trading Volume in November 2023

Doo Group, a pre-eminent financial services group with FinTech as its core, recently released its November 2023 trading volume report.

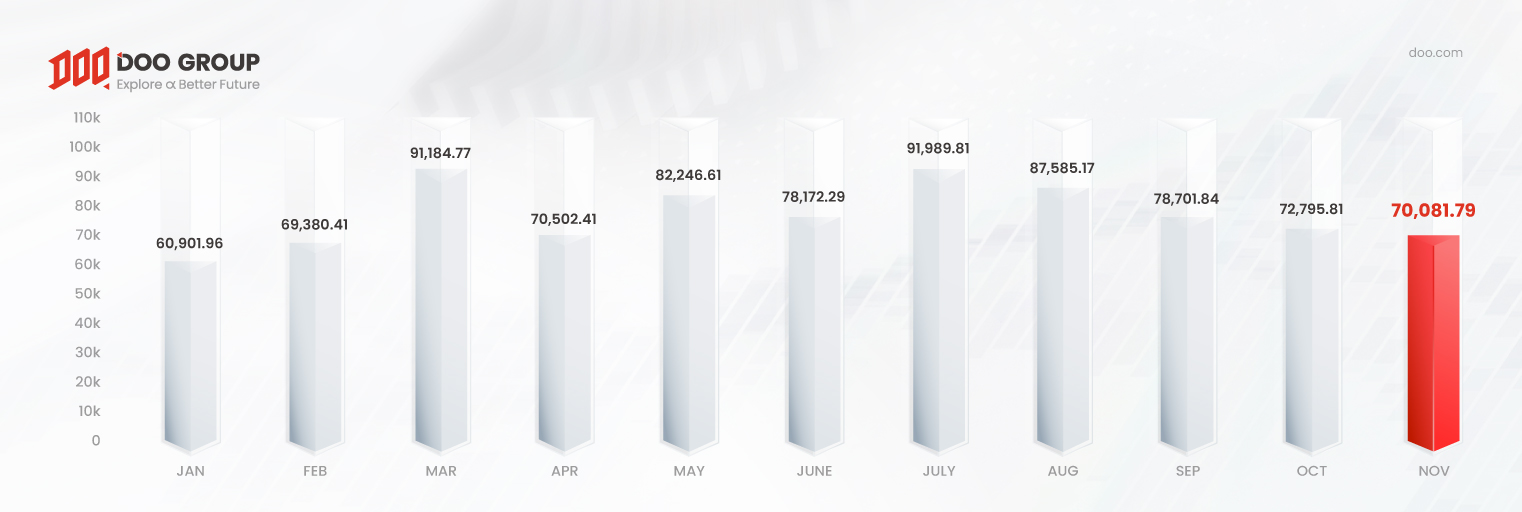

November Trading Volume Overview 2023

- Total trading volume: USD 70.08 billion

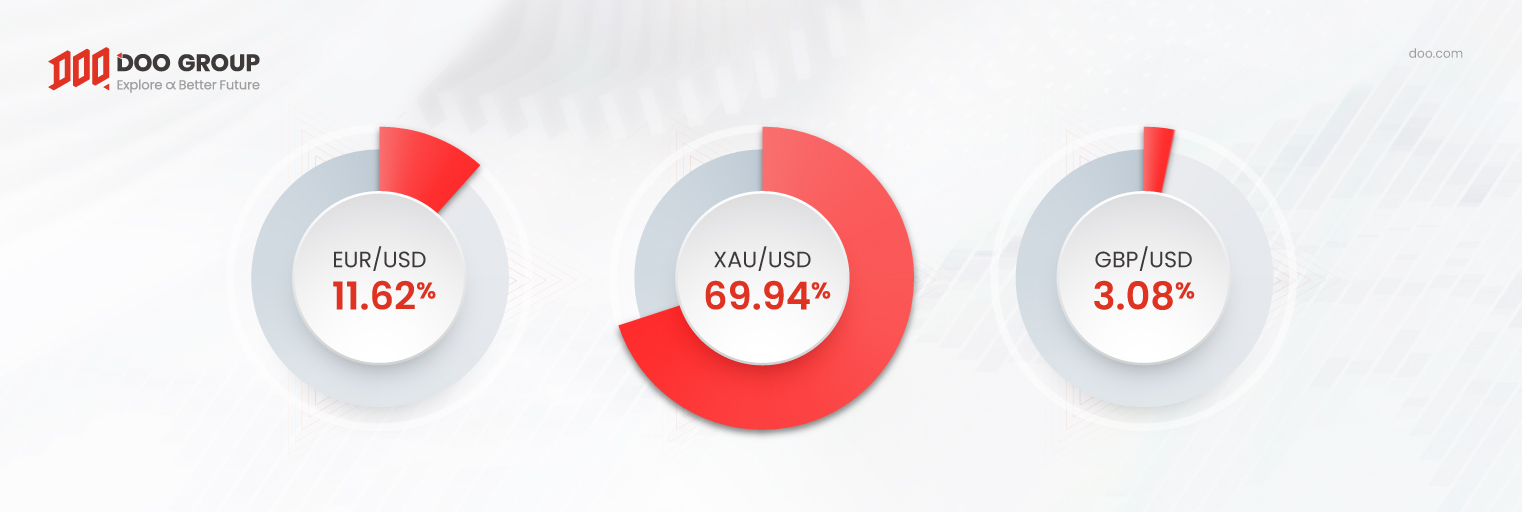

- Most Popular products: XAU/USD, EUR/USD, GBP/USD

- XAU/USD saw the highest trading volume at USD 49.02 billion

- EUR/USD saw the highest increase, an increase of USD 1.89 billion or 30.15%

According to the report, Doo Group’s total trading volume in November 2023 is valued at USD 70.08 billion, a slight drop of 3.73% from the previous month. Additionally, November’s average daily volume (ADV) is USD 2.34 billion, a slight decrease of 0.52% from October.

Investors’ risk aversion has gradually decreased as the US economy slowed down and the inflation pressure declined. Furthermore, the market predicts that the Federal Reserve will be deflating its quantitative tightening (QT) cushion, causing the traders’ risk appetite to rise, reducing their interest in the risk-averse assets such as gold. For the record, XAU/USD has always been one of the main products in exchange among traders. Therefore, the overall trading volume in November has slightly slowed down.

Since the beginning of 2023, Doo Group’s overall trading volume has been on a stable upward trend. Year to date, Doo Group’s total trading volume is valued at USD 853.54 billion, an increase of 40.33% as compared to the same period last year.

It is important to note that gold closed at USD 2,070/ounce in November, and it is the fourth time gold has reached this level since June 2020. This shows that gold prices still have room to go further upward, and gold’s trading volume may significantly increase in December. This may lead to an increase in Doo Group’s overall trading volume.

According to the recorded data, XAU/USD, EUR/USD, and GBP/USD were the investors’ top picks, contributing 84.64% of November’s total trading volume. Among them, XAU/USD has the highest monthly trading volume at USD 49.02 billion; meanwhile, EUR/USD and GBP/USD have a total monthly trading volume of USD 10.3 billion.

Besides, EUR/USD has the largest growth in the monthly trading volume, an increase of USD 1.89 billion or 30.15%, as compared to October.

As an internationally leading financial services group, Doo Group continues to show a strong momentum in its trading volume. In the future, Doo Group will continue to develop a global FinTech system and build a comprehensive financial ecosystem, striving to lead the fintech transformation in this era, ensuring that its clients are at the forefront of the industry.

About Doo Group

Doo Group, established in 2014 and headquartered in Singapore, is an international financial services group with FinTech as its core. Operating through six major business lines, including Brokerage, Wealth Management, Payment Exchange, FinTech, Financial Education, and Health Care, Doo Group continually strengthens our financial ecosystem. We are dedicated to providing comprehensive financial services and innovative solutions to clients worldwide. Together, we embark on a journey to Explore α Better Future.

Currently, the entities within Doo Group, according to their location and products, are regulated by many of the top global financial regulators, including, but not limited to the United States Securities and Exchange Commission (US SEC) and Financial Industry Regulatory Authority (US FINRA), United Kingdom Financial Conduct Authority (UK FCA), the Australian Securities & Investments Commission (ASIC), the Australian Transaction Reports and Analysis Centre (AUSTRAC), the Hong Kong Securities and Futures Commission (HK SFC), the Hong Kong Insurance Authority (HK Insurance Broker), the Hong Kong Companies Registry (HK Trust Company), the Hong Kong Customs and Excise Department (HK Money Service Operator), the Hong Kong Estate Agents Authority (HK EAA), the Malaysia Labuan Financial Services Authority (MY Labuan FSA), the Seychelles Financial Services Authority (SC FSA), Mauritius Financial Services Commission (MU FSC), and the Vanuatu Financial Services Commission (VU FSC). Doo Group has entities operating in various global locations, including Dallas, London, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur as well as other regions.

For enquiries and further information, please contact us:

Official Website: doo.com

Hong Kong: +852 2632 9557

Singapore: +65 6011 1736

Email: [email protected]

Forward-looking Statement

“Forward-looking” Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Group will be generally assumed as forward-looking statements.

Doo Group has provided these forward-looking statements based on all current information available to Doo Group and Doo Group’s current expectations, assumptions, estimates, and projections. While Doo Group believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Group’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Group does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Group is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

This article is for information purposes only and should not be construed as investment advice. Doo Group does not make any representations or warranties regarding the accuracy or completeness of the information provided.

Please make sure you read and fully understand the risks of the products or services described in this article before engaging any transaction with us. You should seek independent professional advice if you do not understand the risks disclosed herein.

Disclaimer

This information is addressed to the general public for informational purposes only and should not be taken as investment or professional advice, recommendation, offer, or solicitation to buy or sell any products mentioned here. The information displayed here has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation.

Any references to the past performance of a product shall not be taken as a reliable indicator of its future results. Doo Group makes no representations or warranties regarding the information displayed here and shall not be liable for any direct or indirect loss or damages incurred by the reader as a result of using the information provided.

-

Doo Group Reports Record Trading Volume in June 2024News | 15 Jul 2024 10:44/AM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its June 2024 trading volume report. June Trading Volume Overview 2024…

Doo Group Reports Record Trading Volume in June 2024News | 15 Jul 2024 10:44/AM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its June 2024 trading volume report. June Trading Volume Overview 2024… -

Doo Group 2024 Mid-Year ReportNews | 28 Jun 2024 10:54/AM GTM

Doo Group 2024 Mid-Year ReportNews | 28 Jun 2024 10:54/AM GTM -

Doo Group Joins Forces with Star Nest to Innovate the Future of Web3 Music EcosystemNews | 27 Jun 2024 11:29/AM GTMFollowing the advent of digitalization, the digital transformation of the music industry has become a leading trend, and Web3 technology has shown great potential in reshapin…

Doo Group Joins Forces with Star Nest to Innovate the Future of Web3 Music EcosystemNews | 27 Jun 2024 11:29/AM GTMFollowing the advent of digitalization, the digital transformation of the music industry has become a leading trend, and Web3 technology has shown great potential in reshapin… -

Celebrating Festivities While Riding the Waves: Doo Group Sponsors the 9th FCAS International Dragon Boat Race 2024News | 25 Jun 2024 11:19/AM GTMThe Federation of Chinese Associations Sabah (FCAS) organized the 9th FCAS International Dragon Boat Race from 7 to 9 June 2024, at Likas Bay, Kota Kinaba…

Celebrating Festivities While Riding the Waves: Doo Group Sponsors the 9th FCAS International Dragon Boat Race 2024News | 25 Jun 2024 11:19/AM GTMThe Federation of Chinese Associations Sabah (FCAS) organized the 9th FCAS International Dragon Boat Race from 7 to 9 June 2024, at Likas Bay, Kota Kinaba… -

First 18 Months of Partnership: Doo Group and Manchester United Progress Towards a Better FutureNews | 19 Jun 2024 10:54/AM GTMDoo Group is excited to announce that we have successfully concluded our first anniversary of our partnership with Manchester United. To commemorate this signifi…

First 18 Months of Partnership: Doo Group and Manchester United Progress Towards a Better FutureNews | 19 Jun 2024 10:54/AM GTMDoo Group is excited to announce that we have successfully concluded our first anniversary of our partnership with Manchester United. To commemorate this signifi…

Newsletter

Instantly grasp the latest insightful trading views