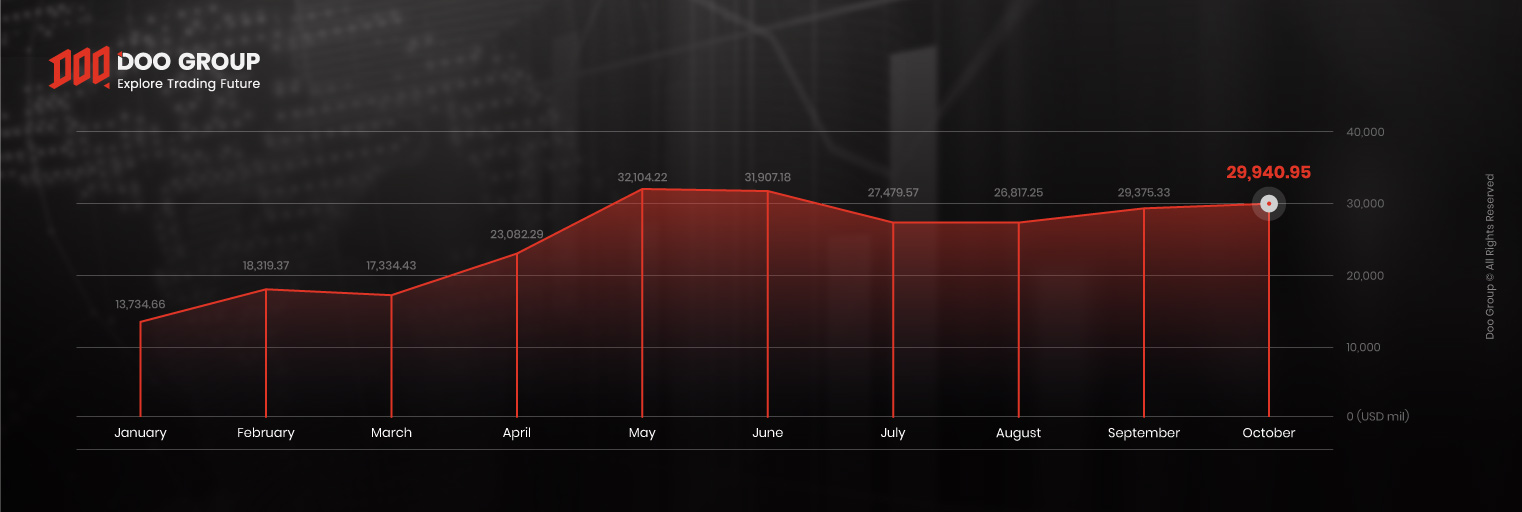

Doo Group Reports Record Trading Volume In October 2021

October 2021 Trading Volume Overview

- Total trading volume: USD29.94 billion

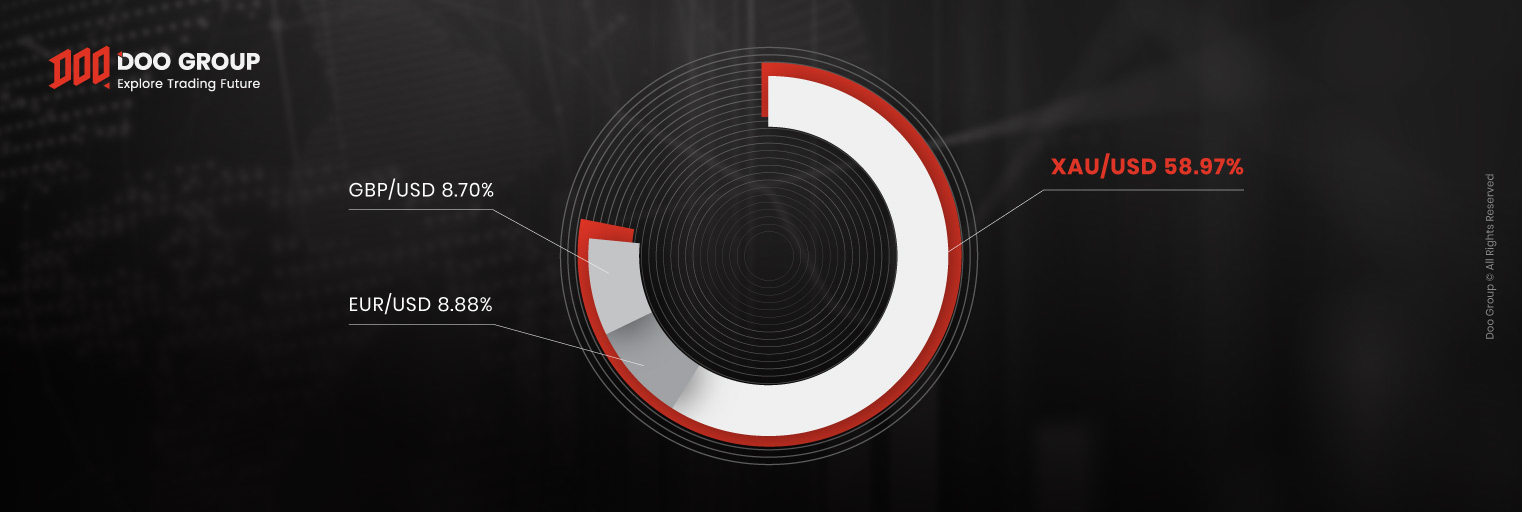

- Most popular currency pairs of traders: XAU/USD, EUR/USD, and GBP/USD

- XAU/USD recorded a total traded of USD17.66 billion

- XAU/USD posted the highest increase of 11.80% (+USD1.86 billion)

Doo Group, a financial services group with cutting-edge technology and solutions, recorded USD29.94 billion of total trading volume in October 2021.

Total trading volume increased by 1.93% compared with the previous month. In addition, on a yearly basis, the trading volume dipped by 45% compared with October’s figure in 2020. In October 2020, total trading volume was USD54.39 billion.

Meanwhile, average daily volume (ADV) in October 2021 was USD965.84 million.

With those figures, Doo Group’s total volume traded for the year to date of 2021 is valued at USD250.10 billion.

Doo Group has been reporting positive growth in its trading volume since February 2021. Although there was a slight decrease in March, June, July, and August, the trend is still going strong. In 2021, the highest traded month up to date still belongs to May.

This number is a total of trading volumes from the Group’s affiliates, Doo Clearing, which is a London-based FCA-regulated liquidity provider, and Doo Prime, a leading global online broker.

According to the latest numbers, XAU/USD, EUR/USD, and GBP/USD remain the leading choice for traders. They took up 76.55% of total trading volume in October 2021.

In addition, XAU/USD recorded a total of USD17.66 billion of the overall monthly trading volume. The other two strongest pairings are EUR/USD and GBP/USD, which recorded USD5.26 billion of the overall monthly trading volume.

The XAU/USD pairing also posted the highest increase in monthly trading volume, with USD1.86 billion, or 11.80%.

While there are many factors contributing to this growth, there is no question that Doo Group has the capability to exemplify this powerful performance in months and years to come.

The company will continue to create a global fintech system and lead the way to a new era of fintech-driven globalization.

As a financial services group, Doo is committed to establishing a financial ecosystem network that empowers clients to stay one step ahead.

About Doo Group

Established in 2014, Doo Group is headquartered in Singapore. After years of development, the Doo Group has become a large fintech-motivated financial service group, comprised of affiliates including Doo Clearing, Doo Financial, Doo Prime, and Doo Tech.

Doo Group is committed in serving individuals and institutional customers around the world with innovative trading brokerage services for securities, futures, Contract For Differences (CFDs), and other financial products.

Currently, some of the legal entities under Doo Group are regulated by financial regulators around the world, including the US Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), the UK Financial Conduct Authority (FCA), the Mauritius Financial Services Commission (MFSC) and the Vanuatu Financial Services Commission (VFSC), with operating centres located in Dallas, London, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

Visit us at www.doogroup.com

For enquiries and further information, please contact us:

Hong Kong: +852 6701 2091

Email: [email protected]

Newsletter

Instantly grasp the latest insightful trading views