Doo Group Reports Record Trading Volume in October 2025

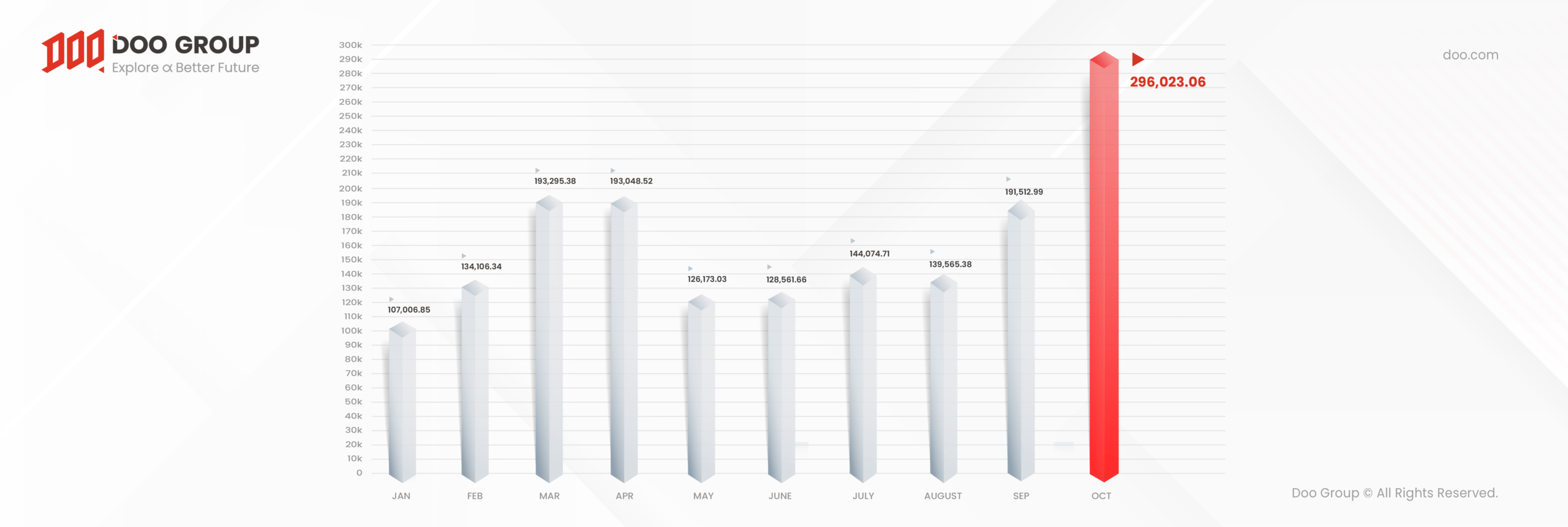

Doo Group, a pre-eminent financial services group with FinTech as its core, recently released its October 2025 trading volume.

October Trading Volume Overview 2025

- Total Trading Volume: USD 296.02 billion (an increase of 37.22% from September 2025).

- Most Popular Products: XAU/USD, EUR/USD, NAS100, GBP/USD, BTC/UST

- XAU/USD saw the highest increase in trading volume, with USD 103.5 billion growth.

- XCU/USD saw the highest increase in percentage growth, a surge of 430.83%.

According to the recorded data, Doo Group’s total trading volume in October is valued at USD 296.02 billion, an increase of 54.75% from the previous month. Furthermore, October’s average daily volume (ADV) is USD 9.549 billion, a rise of 49.58% from September. This significant growth was mainly driven by heightened global geopolitical tensions, fluctuations in major central banks’ monetary policy expectations, and trading opportunities arising from the historic volatility in the gold market.

In October, the global financial market experienced heightened volatility amid a mix of uncertainties. The U.S. government shutdown and the delay in key economic data releases intensified concerns over the country’s fiscal credibility. Meanwhile, escalating tensions in the Middle East fueled risk aversion, while fluctuating expectations surrounding the Federal Reserve’s interest rate cuts led to significant swings in the U.S. dollar index.

Driven by these factors, the gold market went through a “roller-coaster” month. Gold prices surged past the USD 4,000/oz mark at the start of October. Briefly approached a historic high of USD 4,400 mid-month, then retraced to around USD 3,900 before rebounding to USD 4,023 by month-end. The rich trading opportunities made XAU/USD the most actively traded product, with its trading volume increasing by approximately USD 103.5 billion compared to the previous month.

As for the investors’ top picks, XAU/USD, EUR/USD, NAS100, GBP/USD, BTC/UST are the top 5 most popular products in October. Beyond major currency pairs, trading activity in index products such as NAS100 remained strong, indicating that investors actively adjusted their stock holdings and allocations amid market volatility. XCU/USD recorded the largest growth in trading volume, surging by 430.83%, reflecting a market-wide repricing of global industrial demand and economic cycles.

As an internationally leading financial services group, Doo Group continues to show strong momentum in its trading volume. In the future, Doo Group will continue to develop a global FinTech system and build a comprehensive financial ecosystem, to lead the FinTech transformation in this era.

Disclaimer:

Doo Group is a brand name and does not represent a legal entity or a regulated financial institution. The financial services, trading activities, and operations referenced in this report are conducted by legally registered and licensed entities operating under the Doo Group brand framework. Each entity operates independently in compliance with the applicable laws and regulations of its respective jurisdiction.

This report is for general informational purposes only and does not constitute, nor should it be considered, financial, investment, legal, tax, or any other form of professional advice. The content provided, including but not limited to data, analysis, and market commentary, is based on internal records and/or publicly available information and may be subject to change or revision at any time without prior notice. Past performance is not indicative of future results, nor can any views, forecasts, or expected outcomes be guaranteed. The market commentary in this report is intended solely for general reference and does not constitute any trading or investment advice.

Doo Group and its affiliated entities make no representation or warranties about the accuracy or completeness of the information herein and accept no liability for any direct, indirect, incidental, consequential, or other forms of loss or damage arising out of or in connection with the use of or reliance on any information contained in this report. We strongly recommend that readers conduct their own research and consult qualified financial advisors or professionals before making any financial, trading, or investment decisions.

For further details on the legal entities under Doo Group and their regulatory status, please refer to our official website or contact us directly.

-

Doo Group Showcases at the Singapore FinTech Festival 2025: Creating a New Blueprint for Finance.Event | 19 Nov 2025 05:45/PM GTMFrom 12 - 14 November 2025, the global FinTech industry gathered at the Singapore Expo to mark the country’s 60th Independence Anniversary and the 10th Anniversary of…

Doo Group Showcases at the Singapore FinTech Festival 2025: Creating a New Blueprint for Finance.Event | 19 Nov 2025 05:45/PM GTMFrom 12 - 14 November 2025, the global FinTech industry gathered at the Singapore Expo to mark the country’s 60th Independence Anniversary and the 10th Anniversary of… -

Moving Forward Without Limits: Celebrating Doo Group’s 11th AnniversaryNews | 18 Nov 2025 10:45/AM GTMDoo Group celebrates its 11th anniversary on 18th November 2025. Eleven years mark not just a milestone, but a journey of growth and reflection. Since our foundi…

Moving Forward Without Limits: Celebrating Doo Group’s 11th AnniversaryNews | 18 Nov 2025 10:45/AM GTMDoo Group celebrates its 11th anniversary on 18th November 2025. Eleven years mark not just a milestone, but a journey of growth and reflection. Since our foundi… -

Doo Group Reports Record Trading Volume in September 2025News | 21 Oct 2025 03:03/PM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its September 2025 trading volume. September Trading Volume Overview 2025…

Doo Group Reports Record Trading Volume in September 2025News | 21 Oct 2025 03:03/PM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its September 2025 trading volume. September Trading Volume Overview 2025… -

A Decade of Opportunities: Join Doo Group at Singapore FinTech Festival 2025Blog | 15 Oct 2025 03:00/PM GTMThe world’s premier FinTech event — the Singapore FinTech Festival (SFF) — will take place from November 12 to 14, 2025, at the Singapore Expo. Marking Singap…

A Decade of Opportunities: Join Doo Group at Singapore FinTech Festival 2025Blog | 15 Oct 2025 03:00/PM GTMThe world’s premier FinTech event — the Singapore FinTech Festival (SFF) — will take place from November 12 to 14, 2025, at the Singapore Expo. Marking Singap… -

Doo Group August 2025 Trading Volume ReportNews | 29 Sep 2025 03:44/PM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its August 2025 trading volume. August Trading Volume Overview 2025 …

Doo Group August 2025 Trading Volume ReportNews | 29 Sep 2025 03:44/PM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its August 2025 trading volume. August Trading Volume Overview 2025 …

Newsletter

Instantly grasp the latest insightful trading views