Doo Group Reports Record Trading Volume In September 2022

Doo Group, a pre-eminent financial services group with financial technology at its core, recently released its September 2022 trading volume report.

September 2022 Trading Volume Overview

- Total trading volume: USD54.19 billion

- Most popular products: XAU/USD, EUR/USD, GBP/USD

- XAU/USD recorded the highest trading volume at USD32.57 billion

- GBP/CAD posted the highest increase of 239.81% (+USD670 million)

(The report data demonstrates the total trading volume of Doo Group’s sub-brands, Doo Clearing and Doo Prime.)

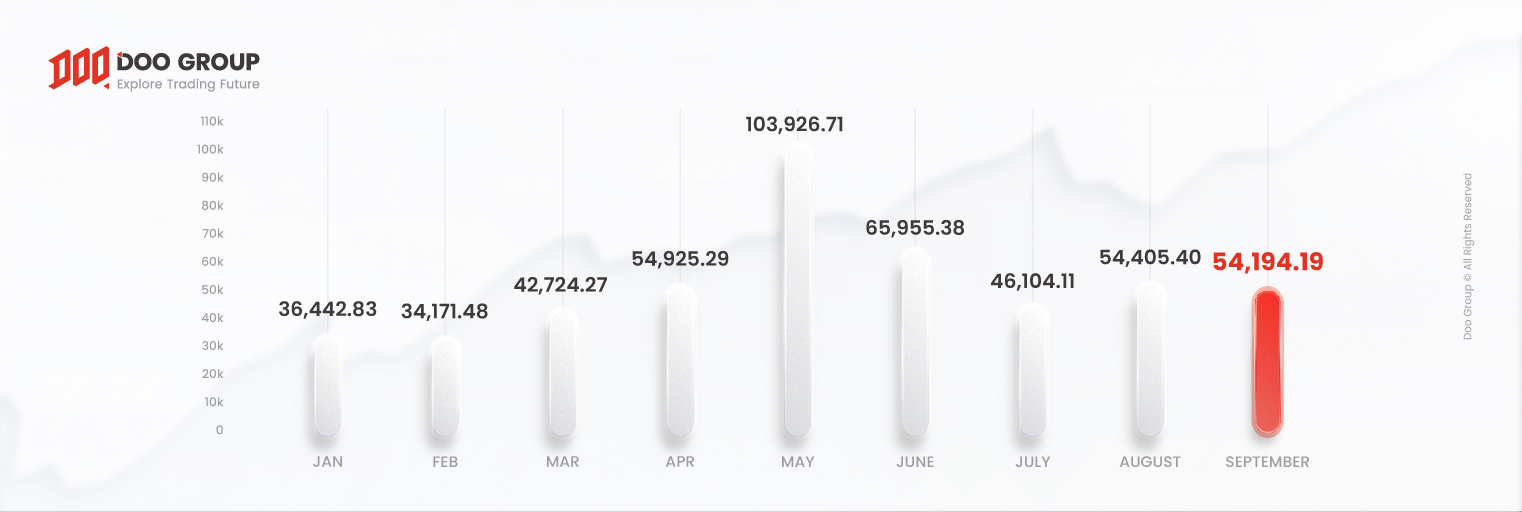

According to the report, Doo Group’s total trading volume in September 2022 sits at USD54.19 billion, a slight decrease of 0.39% from the previous month. However, it was a significant increase of approximately 84.5% from USD29.38 billion in the same month last year. On top of that, the average daily volume in September reached USD1.81 billion, an increase of 2.93% from the figure in August.

Doo Group’s trading volume has been increasing steadily since the beginning of the year. Besides the breakthrough growth in May, trading volume in other months maintained a steadily upward trend. Trading volume in September fell slightly compared to the previous month, presumably due to the active rate hike in the US dollar, which led to sharp fluctuations in related products. In this case, some investors chose to avoid the volatile market as much as possible. Year-to-date, Doo Group’s total trading volume has reached USD492.85 billion, an increase of 123.86% over the same period last year.

According to the data, XAU/USD, EUR/USD and GBP/USD were the top choices of traders for the month, accounting for 74.50% of the total trading volume in September. XAU/USD had the highest monthly trading volume of about USD32.57 billion, while EUR/USD and GBP/USD had a total monthly trading volume of about USD7.80 billion.

In addition, GBP/CAD saw the largest monthly volume growth, increasing by USD670 million or 239.81% from August.

As an industry-leading financial services group, Doo Group has been showing strong momentum in terms of trading volume. In the future, Doo Group aspires to continuously build a global financial technology system and a comprehensive financial ecosystem. Doo Group will strive for excellence through its journey of leading the new fintech era, keeping its clients at the forefront in the industry.

About Doo Group

Doo Group was established in 2014, currently headquartered in Singapore. After years of development, Doo Group has become a multi-faceted financial services group with financial technology as its core. With multiple sub-brands such as Doo Clearing, Doo Financial, Doo Prime, FinPoints and more, Doo Group is committed to provide trading and asset management services for over 20,000 financial products such as Securities, Futures, Forex, CFDs and Funds to global individual and institutional clients.

Currently, the entities within Doo Group, according to their location and products, are regulated by many of the top global financial regulators, including, but not limited to, the United States Securities and Exchange Commission (US SEC) and Financial Industry Regulatory Authority (US FINRA), United Kingdom Financial Conduct Authority (UK FCA), the Australian Securities & Investments Commission (AU ASIC), the Hong Kong Insurance Authority (HK IA), the Hong Kong Customs and Excise Department (HK C&ED), the Hong Kong Companies Registry (HK CR), the Seychelles Financial Services Authority (SC FSA), Mauritius Financial Services Commission (MU FSC), and the Vanuatu Financial Services Commission (VU FSC). Doo Group has entities operating in various global locations, including Dallas, London, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur as well as other regions.

For enquiries and further information, please contact us:

Hong Kong: +852 6701 2091

Singapore: +65 6011 1736

Email: [email protected]

Forward-looking Statement

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Group will be generally assumed as forward-looking statements.

Doo Group has provided these forward-looking statements based on all current information available to Doo Group and Doo Group’s current expectations, assumptions, estimates, and projections. While Doo Group believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Group’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Group does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Group is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with us. You should seek independent professional advice if you do not understand the risks disclosed by us herein.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future results. Doo Group makes no representation and warranties to the information displayed and shall not be liable for any direct or indirect loss or damages as a result of any inaccuracies and incompleteness of the information provided. Doo Group shall not be liable for any loss or damages as a result of any direct or indirect trading risks, profit, or loss associated with any individual’s investment.

-

Doo Group Reports Record Trading Volume in November 2025Blog | 18 Dec 2025 12:30/PM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its November 2025 trading volume. November Trading Volume Overview 20…

Doo Group Reports Record Trading Volume in November 2025Blog | 18 Dec 2025 12:30/PM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its November 2025 trading volume. November Trading Volume Overview 20… -

Doo Group Reports Record Trading Volume In May 2022News | 16 Jun 2022 04:00/PM GTMDoo Group, a large financial services group with financial technology at its core, recently released its May 2022 trading volume report. May 2022 Trading Volume Overview …

Doo Group Reports Record Trading Volume In May 2022News | 16 Jun 2022 04:00/PM GTMDoo Group, a large financial services group with financial technology at its core, recently released its May 2022 trading volume report. May 2022 Trading Volume Overview … -

Doo Group Reports Record Trading Volume In March 2022News | 12 Apr 2022 04:18/PM GTMDoo Group, a large financial services group with financial technology at its core, recently released its March 2022 trading volume report. March 2022 Trading Volume Overv…

Doo Group Reports Record Trading Volume In March 2022News | 12 Apr 2022 04:18/PM GTMDoo Group, a large financial services group with financial technology at its core, recently released its March 2022 trading volume report. March 2022 Trading Volume Overv… -

Doo Group Reports Record Trading Volume In February 2022News | 15 Mar 2022 02:30/PM GTMDoo Group, a large financial services group with financial technology at its core, recently released its February 2022 trading volume report. February 2022 Trading Volume …

Doo Group Reports Record Trading Volume In February 2022News | 15 Mar 2022 02:30/PM GTMDoo Group, a large financial services group with financial technology at its core, recently released its February 2022 trading volume report. February 2022 Trading Volume … -

Doo Group Reports Record Trading Volume In January 2022News | 15 Feb 2022 03:31/PM GTMDoo Group, a large financial services group with financial technology at its core, recently released its January 2022 transaction volume report. January 2022 Trading Volum…

Doo Group Reports Record Trading Volume In January 2022News | 15 Feb 2022 03:31/PM GTMDoo Group, a large financial services group with financial technology at its core, recently released its January 2022 transaction volume report. January 2022 Trading Volum…

Newsletter

Instantly grasp the latest insightful trading views