Doo Group Reports Record Trading Volume in September 2024

Doo Group, a pre-eminent financial services group with FinTech as its core, recently released its September 2024 trading volume report.

September Trading Volume Overview 2024

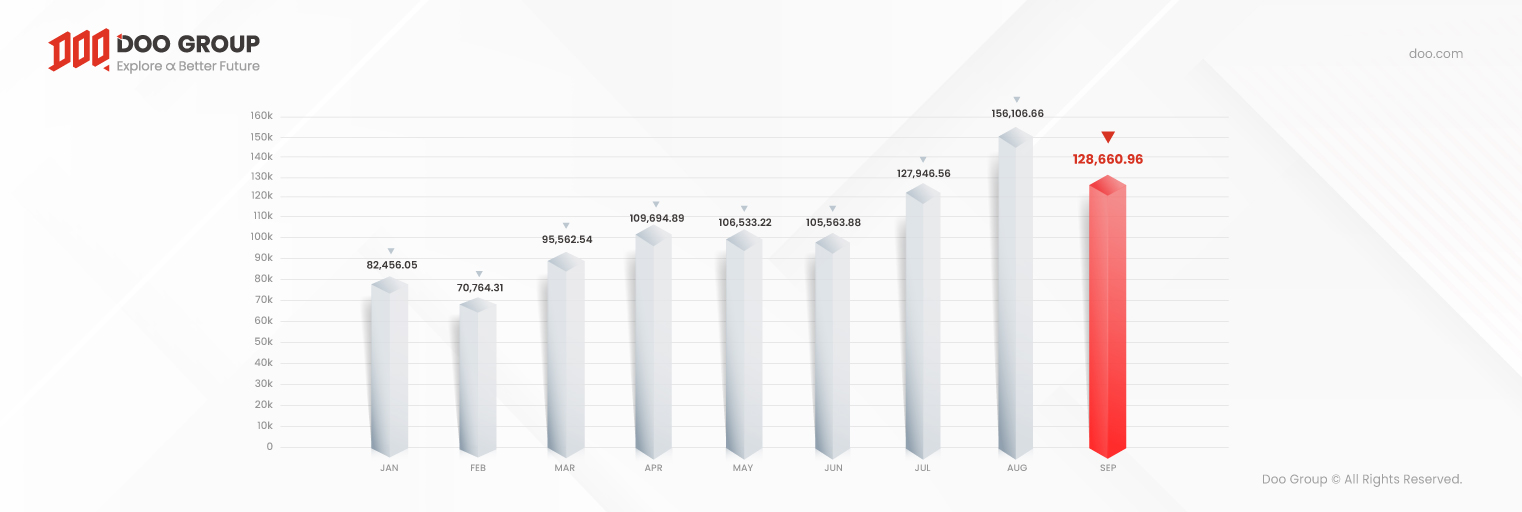

- Total Trading Volume: USD 128.66 billion

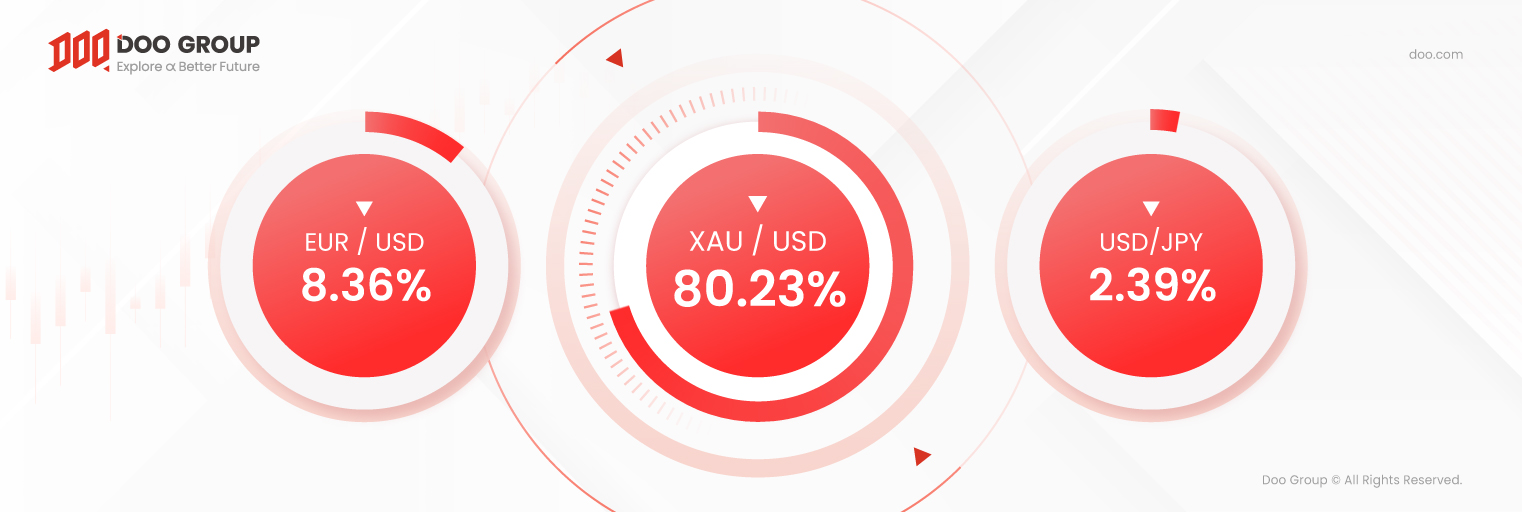

- Most Popular Products: XAU/USD, EUR/USD, USD/JPY

- XAU/USD saw the highest trading volume at USD 103.23 billion.

- HSI_2409 saw the highest increase, an increase of USD 0.17 billion, or 138.16%

According to the report, Doo Group’s total trading volume in September 2024 is valued at USD 128.66 billion, a decline of 17.58% from the previous month. Furthermore, September’s average daily volume (ADV) is USD 4.29 billion, a decrease of 14.83% from August.

On September 18, the Federal Reserve (Fed) enacted its first interest rate cut in 4 years, lowering the federal funds rate with a 50-basis point reduction to 4.75%-5%. This enactment was to ease the economic pressure in the US. However, the market indicated that this is a sign that the US is facing a weakening economy.

Due to that, investors’ concern about future economic growth has risen and raised questions on whether there will be further rate cuts and the ability to achieve a soft landing. Therefore, investors have taken a “wait and see” approach in September, and trading activities have descended. Doo Group’s September ADV has also declined as compared to August, causing the overall trading volume to drop.

Year to date, however, Doo Group’s total trading volume is valued at USD 983.30 billion, an expansion of 38.36% as compared to the same period last year.

According to the recorded data, XAU/USD, EUR/USD, and USD/JPY were the investors’ top picks, contributing 90.98% of September’s total trading volume. Among them, XAU/USD has the highest monthly trading volume at USD 103.23 billion; while EUR/USD and USD/JPY have a total monthly volume of USD 13.83 billion.

Besides, HSI_2409 has the largest growth in the monthly trading volume, an increase of USD 0.17 billion or 138.16% as compared to August.

As an internationally leading financial services group, Doo Group continues to show strong momentum in its trading volume. In the future, Doo Group will continue to develop a global FinTech system and build a comprehensive financial ecosystem. We strive to lead the FinTech transformation in this era, ensuring that our clients are at the forefront of the industry.

-

Doo Group Showcases at the Singapore FinTech Festival 2025: Creating a New Blueprint for Finance.Event | 19 Nov 2025 05:45/PM GTMFrom 12 - 14 November 2025, the global FinTech industry gathered at the Singapore Expo to mark the country’s 60th Independence Anniversary and the 10th Anniversary of…

Doo Group Showcases at the Singapore FinTech Festival 2025: Creating a New Blueprint for Finance.Event | 19 Nov 2025 05:45/PM GTMFrom 12 - 14 November 2025, the global FinTech industry gathered at the Singapore Expo to mark the country’s 60th Independence Anniversary and the 10th Anniversary of… -

Moving Forward Without Limits: Celebrating Doo Group’s 11th AnniversaryNews | 18 Nov 2025 10:45/AM GTMDoo Group celebrates its 11th anniversary on 18th November 2025. Eleven years mark not just a milestone, but a journey of growth and reflection. Since our foundi…

Moving Forward Without Limits: Celebrating Doo Group’s 11th AnniversaryNews | 18 Nov 2025 10:45/AM GTMDoo Group celebrates its 11th anniversary on 18th November 2025. Eleven years mark not just a milestone, but a journey of growth and reflection. Since our foundi… -

Doo Group Reports Record Trading Volume in October 2025News | 17 Nov 2025 11:31/AM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its October 2025 trading volume. October Trading Volume Overview 2…

Doo Group Reports Record Trading Volume in October 2025News | 17 Nov 2025 11:31/AM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its October 2025 trading volume. October Trading Volume Overview 2… -

Doo Group Reports Record Trading Volume in September 2025News | 21 Oct 2025 03:03/PM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its September 2025 trading volume. September Trading Volume Overview 2025…

Doo Group Reports Record Trading Volume in September 2025News | 21 Oct 2025 03:03/PM GTMDoo Group, a pre-eminent financial services group with FinTech as its core, recently released its September 2025 trading volume. September Trading Volume Overview 2025… -

A Decade of Opportunities: Join Doo Group at Singapore FinTech Festival 2025Blog | 15 Oct 2025 03:00/PM GTMThe world’s premier FinTech event — the Singapore FinTech Festival (SFF) — will take place from November 12 to 14, 2025, at the Singapore Expo. Marking Singap…

A Decade of Opportunities: Join Doo Group at Singapore FinTech Festival 2025Blog | 15 Oct 2025 03:00/PM GTMThe world’s premier FinTech event — the Singapore FinTech Festival (SFF) — will take place from November 12 to 14, 2025, at the Singapore Expo. Marking Singap…

Newsletter

Instantly grasp the latest insightful trading views