Entity under Doo Financial Granted Capital Markets Services (CMS) License by Monetary Authority of Singapore (MAS)

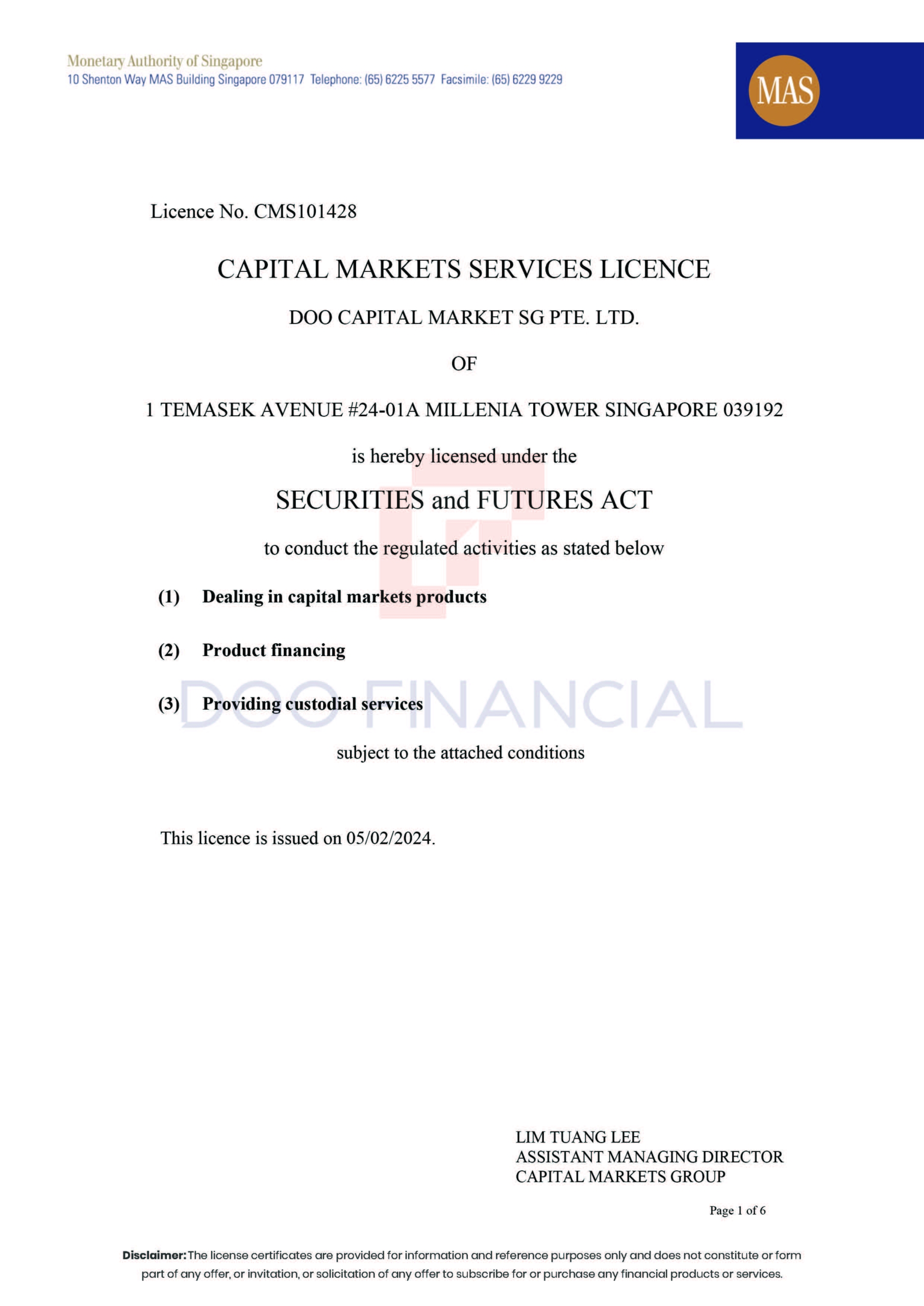

Recently, Doo Capital Market SG Pte. Ltd. (“DCM”), an entity under Doo Financial, has officially been granted with a Capital Markets Services (CMS) license (License Number: CMS101428) from Monetary Authority of Singapore (MAS).

Doo Financial is one of the sub-brands of Doo Group. The acquisition of this license marks a further expansion of Doo Group into the Singapore market, allowing DCM to conduct activities regulated under the Securities and Futures Act 2001 such as dealing in capital markets products, product financing and providing custodial services. DCM is also licensed under the Financial Advisers Act 2001 to provide financial advisory service such as advising on investment products and issuing or promulgating analyses/reports on investment products.

Top-tier Regulatory License

MAS was established in 1971 as a government institution tasked with exercising central banking functions in Singapore. It plays a crucial role in Singapore’s financial system.

Apart from not issuing currency, MAS fully exercises the general functions of a central bank, including the direction of the financial industry and the supervision of bank’s various business practices.

Its objective is to promote the sustainable economic development of the Republic of Singapore as a well-established and sophisticated financial center.

Doo Capital Market SG Pte. Ltd. has been granted a CMS license by MAS after a rigorous vetting process, signifying further recognition of our compliance and professionalism, capital strength as well as risk management capabilities.

At the same time, more professional services will be provided under the authorization of the license to create new investment growth opportunities.

Doo Capital Market SG Pte. Ltd. is licensed to provide the following services:

-Dealing in Capital Markets Products*

-Product Financing

-Providing Custodial Services

-Advising on Investment Products*

-Issuing or Promulgating Analyses/Reports on Investment Products*

Remark: Please note that capital market products and investment products are limited exclusively to securities and exchange-traded derivatives contracts.

Delving into the Dynamic Singapore Market Landscape

In November 2023, Doo Group made a debut at the Singapore FinTech Festival as an international financial services group. During the event, we collaborated with industry experts and leading institutions from around the world to explore the limitless potential of the future financial landscape.

As one of the financial centers in Asia, Singapore has a well-developed financial system and regulatory standards. On top of that, the local government has continued to launch policies and measures to encourage the development of fintech innovation in recent years, which has further heightened the country’s attractiveness for investments. Whether in the areas of international finance, trade finance, asset management or fintech, Singapore maintains its leadership and competitiveness.

It is in recognition of this strategic convergence of a thriving financial ecosystem and a supportive regulatory environment that we have chosen to expand our market presence into Singapore.

The approval of the CMS license at this time will further enhance our influence in the Singapore market, providing clients with a more diversified range of professional financial services to seize the vast opportunities in this thriving market.

Meanwhile, we will also provide secure and reliable financial services in accordance with the stringent regulations of MAS, managing potential risks while achieving clients’ investment objectives.

Adhering to a global development strategy, Doo Group has been actively establishing compliant layouts in major financial markets worldwide, continuously strengthening the group’s ability for compliant operations. The approval of this license is a significant milestone in Doo Group’s global expansion.

Relying on years of industry experience and capital strength, we will continue to explore wealth growth opportunities in both mainstream and emerging markets to help our clients create more value.

-

Doo Financial Receives iFAST’s “Distinguished Global Financial Services Excellence Award” In Recognition of Exceptional PerformanceNews | 26 Apr 2024 04:02/PM GTMOn 11 April, Doo Financial Australia Limited, an entity under Doo Financial, a brokerage business brand under Doo Group, received the “Distinguished Global Financi…

Doo Financial Receives iFAST’s “Distinguished Global Financial Services Excellence Award” In Recognition of Exceptional PerformanceNews | 26 Apr 2024 04:02/PM GTMOn 11 April, Doo Financial Australia Limited, an entity under Doo Financial, a brokerage business brand under Doo Group, received the “Distinguished Global Financi… -

Doo Financial HK Limited Successfully Obtained Hong Kong Securities and Futures Commission(HK SFC)Type 1 Dealing in Securities LicenseNews | 14 Mar 2024 11:33/AM GTMWe are excited to announce a significant milestone for Doo Group’s subsidiary, Doo Financial HK Limited (Central Entity No.: BSM562), which has successfully secu…

Doo Financial HK Limited Successfully Obtained Hong Kong Securities and Futures Commission(HK SFC)Type 1 Dealing in Securities LicenseNews | 14 Mar 2024 11:33/AM GTMWe are excited to announce a significant milestone for Doo Group’s subsidiary, Doo Financial HK Limited (Central Entity No.: BSM562), which has successfully secu… -

Doo Group Continues Helping Students Achieve Higher Education Through Doo BursaryNews | 07 Jul 2022 05:47/PM GTMIt is graduation season once more, and Doo Group would like to take this opportunity to congratulate all graduates for completing the study year. A big well done to those wh…

Doo Group Continues Helping Students Achieve Higher Education Through Doo BursaryNews | 07 Jul 2022 05:47/PM GTMIt is graduation season once more, and Doo Group would like to take this opportunity to congratulate all graduates for completing the study year. A big well done to those wh… -

Doo Financial Acquires An Insurance Broker Licensed Entity Regulated By The Hong Kong Insurance AuthorityFeatured Articles | 05 Jul 2022 03:01/PM GTMDoo Group’s affiliate, Doo Financial, embarks on a new milestone with the acquisition of a Wealth Management Limited company (IA FB1823), now known as Doo Wealth Man…

Doo Financial Acquires An Insurance Broker Licensed Entity Regulated By The Hong Kong Insurance AuthorityFeatured Articles | 05 Jul 2022 03:01/PM GTMDoo Group’s affiliate, Doo Financial, embarks on a new milestone with the acquisition of a Wealth Management Limited company (IA FB1823), now known as Doo Wealth Man… -

Doo Group Affiliate News: Doo Financial’s First Display On Times Square Nasdaq Tower, Establishing A Fully Disclosed Brokerage Relationship With Interactive BrokersFeatured Articles | 30 Jul 2021 03:01/PM GTMDoo Group affiliate, Doo Financial, an online broker has officially established a fully disclosed brokerage relationship with Interactive Brokers. In celebra…

Doo Group Affiliate News: Doo Financial’s First Display On Times Square Nasdaq Tower, Establishing A Fully Disclosed Brokerage Relationship With Interactive BrokersFeatured Articles | 30 Jul 2021 03:01/PM GTMDoo Group affiliate, Doo Financial, an online broker has officially established a fully disclosed brokerage relationship with Interactive Brokers. In celebra…

Newsletter

Instantly grasp the latest insightful trading views